Dependent Tax Deductions and Credits: Tax Exemptions, Deductions and Credits for Families - TurboTax Tax Tips & Videos

Charity Navigator: Things you should know when choosing between standard and itemized deductions--especially if a charitable contribution was made in 2020

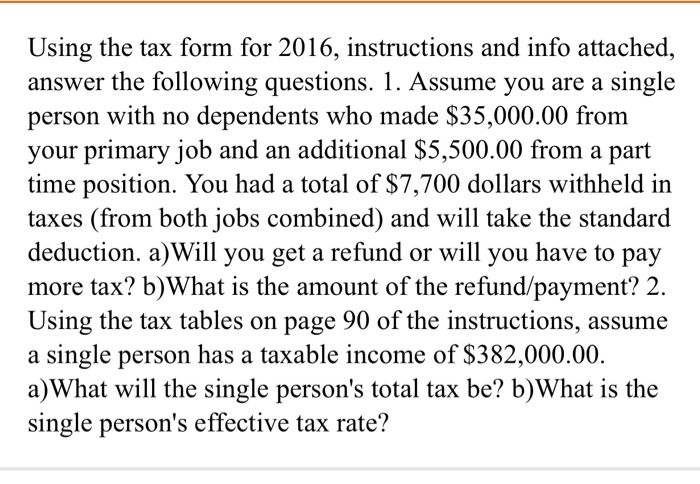

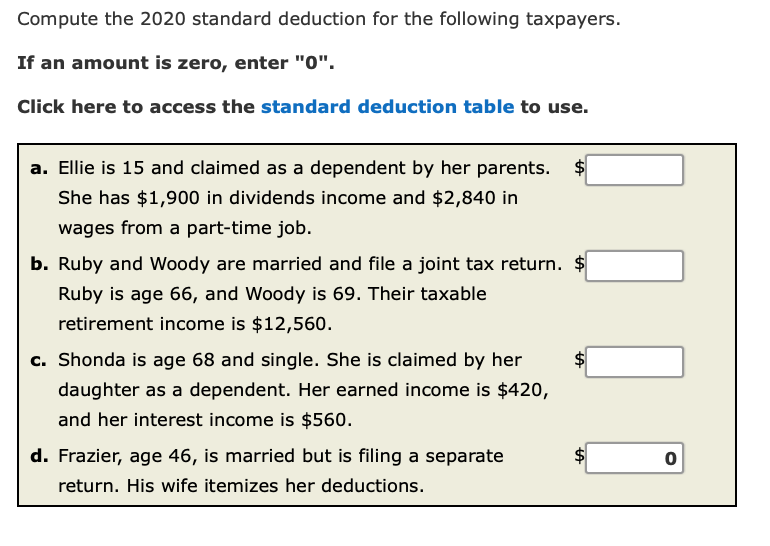

Solved] Jerry Jenkins is over 65 years of age and has no dependents. His only income was his salary of $21,000. During the year, he made only a nomi... | Course Hero

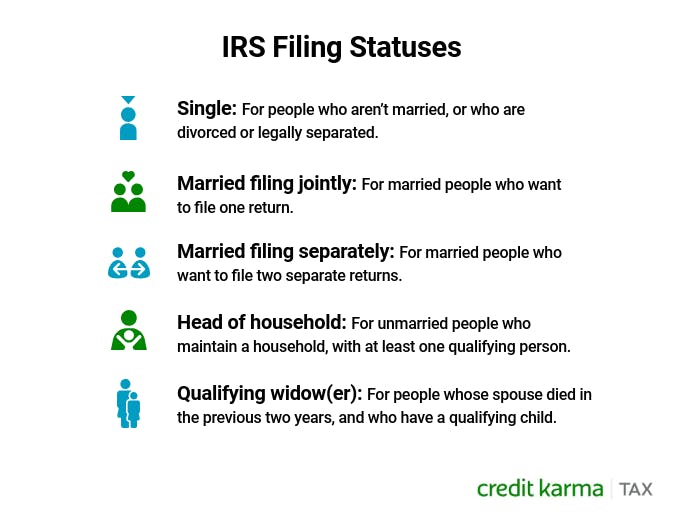

Are you a couple wondering if you should file your taxes jointly or separately? Find out the best option for you this tax season. - masslive.com

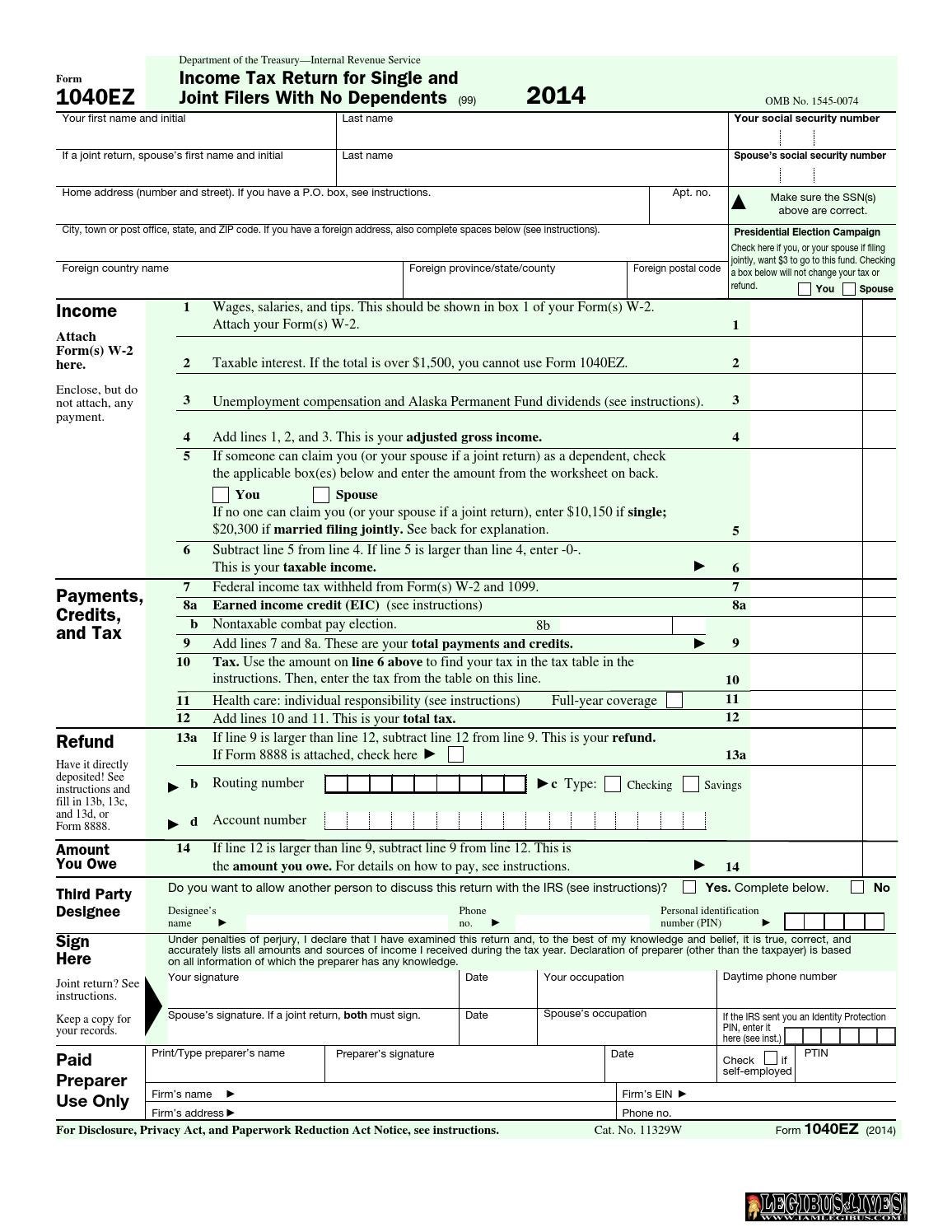

u s individual income tax return forms instructions & tax table (f1040) (i1040)(i1040tt) by Legibus, Inc - Issuu

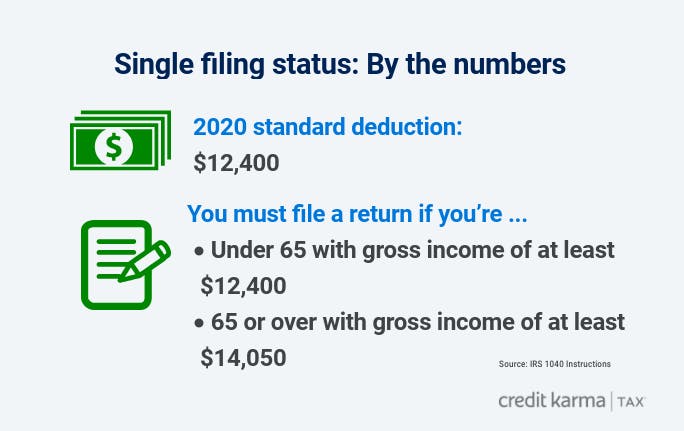

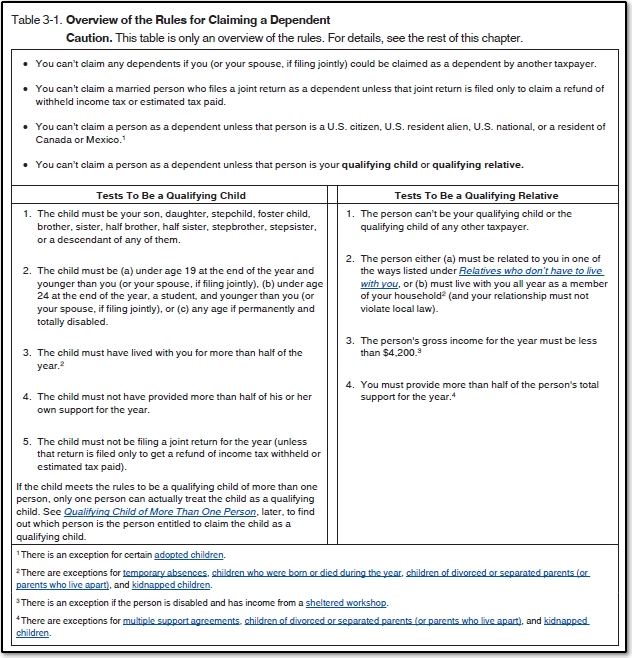

Publication 501 (2020), Dependents, Standard Deduction, and Filing Information | Internal Revenue Service | Standard deduction, Internal revenue service, Deduction

/claiming-adult-dependent-tax-rules-4129176_updated-f6071c45f647429d8fa9a9dc58c0cd74.gif)

/head-of-household-filing-status-3193039_final-e1ff704b38ee49bc83351f263f213ac4.png)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)